If you want to do business in Missouri, but formed your business in another state or jurisdiction, you’ll need to register for a Certificate of Authority with the Missouri Secretary of State, Corporations Division. You can do this by filing an Application for Registration of a Foreign Limited Liability Company and pay the filing fee. Getting foreign qualification for your LLC in Missouri can get complicated, but we’ve put this guide together to walk you through everything you need to know, step by step, so you can start doing business in the Show Me State.

Want an easy way to qualify a foreign LLC in Missouri? Hiring a professional service like Missouri Registered Agent LLC makes it easy to register your foreign LLC in Missouri. Our Out-of-State Registration Service includes the preparation and filing of your state paperwork, a year of our Missouri Registered Agent Service, and compliance reminders when your annual filings are due.

Register Your Foreign LLC in Missouri

If you’d rather register your Foreign LLC on your own, we’ve created a guide to guide you through each step of the process:

- Check to see if your LLC’s name is available

- Appoint a Missouri Registered Agent

- Get a Certificate of Good Standing

- Register your foreign LLC with the state

- Get your Missouri Certificate of Authority

Qualify a Foreign LLC in Missouri

When you’re ready to do business in Missouri, you’ll want to register your foreign LLC by filing an Application for Registration of a Foreign LLC to the Missouri Secretary of State. You’ll get your Certificate of Authority after filing this form and paying the filing fee of $105. If you’re looking to expand your business, Missouri is a great option. Just like Missouri LLCs, foreign LLCs in Missouri are not required to file an annual report or pay an annual franchise tax, saving you the worry of having to keep track of due dates for filings and budgeting for state compliance fees.

1. Check LLC Name Availability

You’ve already gone through the rigmarole of choosing a name for your LLC in your home jurisdiction, but that doesn’t necessarily mean you’ll be able to use it in MO. Before you fill out an application for foreign qualification, you’ll want to use Missouri’s Business Entity Lookup to make sure there isn’t another business entity in the state already using your name.

If your LLC’s name is in use by another business, no problem! You’ll just have to choose a different one to operate in the state. The name you choose will need to meet Missouri’s naming requirements as laid out in RSMo 347.020:

- It cannot be in use by another entity in the state.

- Your LLC’s name needs to include one of the following designators: Limited Liability Company, Limited Company, LLC, LC, L.L.C. or L.C.

- The name you choose cannot include any words that imply the business is a different type of entity. For example, you can’t name your foreign LLC Tad‘s Toasted Ravs Inc. But Tad’s Toasted Ravs LLC is just fine!

Can I reserve a name for my foreign LLC?

Absolutely. Similar to Missouri corporations and LLCs, Missouri foreign LLCs are able to reserve a name by filing an Application for Reservation of Name to the Missouri Corporations Division. The form costs $25 to file, and it will reserve a name for your business for up to 180 days.

2. Appoint a Missouri Registered Agent

You’ll need to get a Missouri registered agent in order to qualify as a foreign LLC. Although you already have a registered agent in your company’s home jurisdiction (and any other jurisdictions your company may already be registered to do business in), the state requires that you appoint a Missouri registered agent. Whoever you appoint as your registered agent must:

- be 18 years or older

- have a physical address in Missouri

- be available to accept legal mail and service of process in person at their Missouri address during regular business hours

Unless you‘re living in Missouri, you won’t be able to appoint yourself as a registered agent for your foreign LLC. You can appoint a Missouri resident you know (with their consent, of course) or a professional registered agent (like us!). Something to keep in mind is that your registered agent’s information will be become public once your application is processed. So, if you or the agent you have in mind is concerned about protecting their privacy, it may be a good idea to hire a professional registered agent who doesn’t mind the public having access to their personal information.

Is a registered agent required in Missouri?

Yes. The state of Missouri requires all business entities to appoint and maintain a registered agent in Missouri (RSMo 351.370). If you fail to do this, the Secretary of State can revoke your foreign qualification, keeping you from doing business in the state. There is also a possibility that both the LLC and its owners could be charged with other penalties and fees.

3. Get a Certificate of Good Standing

Before your LLC can qualify for foreign registration in Missouri you’ll need to provide the Secretary of State with a Certificate of Good Standing from your LLC’s home jurisdiction. A Certificate of Good Standing is a document from the state where your LLC was formed that proves your company is still in good standing. Basically, it’s one state or jurisdiction letting the other know, “It’s all good!” when it comes to your business. If your business is unable to get a certificate you will not be able to register as a foreign LLC in Missouri.

Every state’s a little different, but more likely than not you’ll be able to order your certificate through your domestic jurisdiction’s Secretary of State’s office. Some states charge a fee for this, others don’t. Check with your state’s business filing agency to get the specifics on how to order your certificate.

What if I can’t get a Certificate of Good Standing?

If you’re unable to get a Certificate of Good Standing from your jurisdiction it could be for a myriad of reasons. Some of the most common reasons may be that the LLC has not:

- registered as a business entity with its domestic jurisdiction

- submitted required annual filings

- paid required taxes (like franchise taxes)

If you find you’re unable to obtain a certificate, you’ll want to get your LLC back in compliance with the state. This process varies from state to state, so make sure to check in with your Secretary of State’s office about what your next steps are. Once your LLC is compliant again you’ll be able to get a certificate.

4. Register a Foreign LLC with the Missouri Secretary of State

When it’s time to submit your Application for Registration of a Foreign Limited Liability Company to the Missouri Secretary of State, you have some different options. You can:

- Hire a company that specializes in registering foreign LLCs in Missouri. Guess what? We do this! All you’ll need to do is provide the information for your application and we’ll take care of the filing for you.

- Mail your application to the Missouri Secretary of State, Corporations Division and pay the $105 filing fee.

- Use the Missouri Secretary of State’s Online Business Filing portal to create a free business profile. From there you’ll be able to complete and pay for your application online.

It’s truly easier and faster to file your application online. Check out our guide below to see how you can create an business profile with the Missouri Secretary of State and submit your application.

You’ve decided on a name for your Missouri Foreign LLC, chosen a Missouri registered agent, and got your hands on a Certificate of Good Standing. Now what?

The next step is to complete and submit your Application for Registration of a Foreign Limited Liability Company to the Missouri Secretary of State. Missouri makes it super easy to do this online in through the Missouri filing portal.

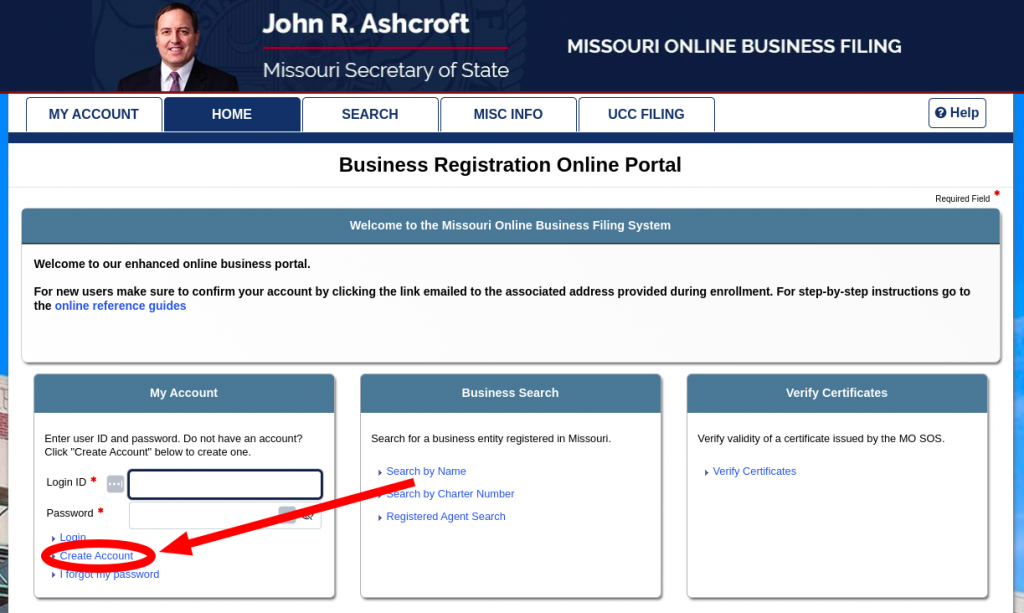

Create an Account with the Missouri Online Business Filing System

First thing’s first: create an online account with the Missouri Secretary of State. In the section titled “My Account” you’ll find boxes for a Login ID and password. Right below, you’ll see “Create Account.” Clicking this link will take you to the Online Account Creation form.

All you need to do to create an account is have a valid email address and provide some personal information:

-

User ID

-

Password

-

Answers to Security Questions

-

Your name

-

Your address

-

Your contact information

Don’t worry! This information will not be publicly available. It’s for Missouri’s records. Once you’ve completed the Online Account Creation form, agree to the terms and conditions by checking the box. And there you go! You now have an online account that will allow you to submit your filings to the Missouri Secretary of State.

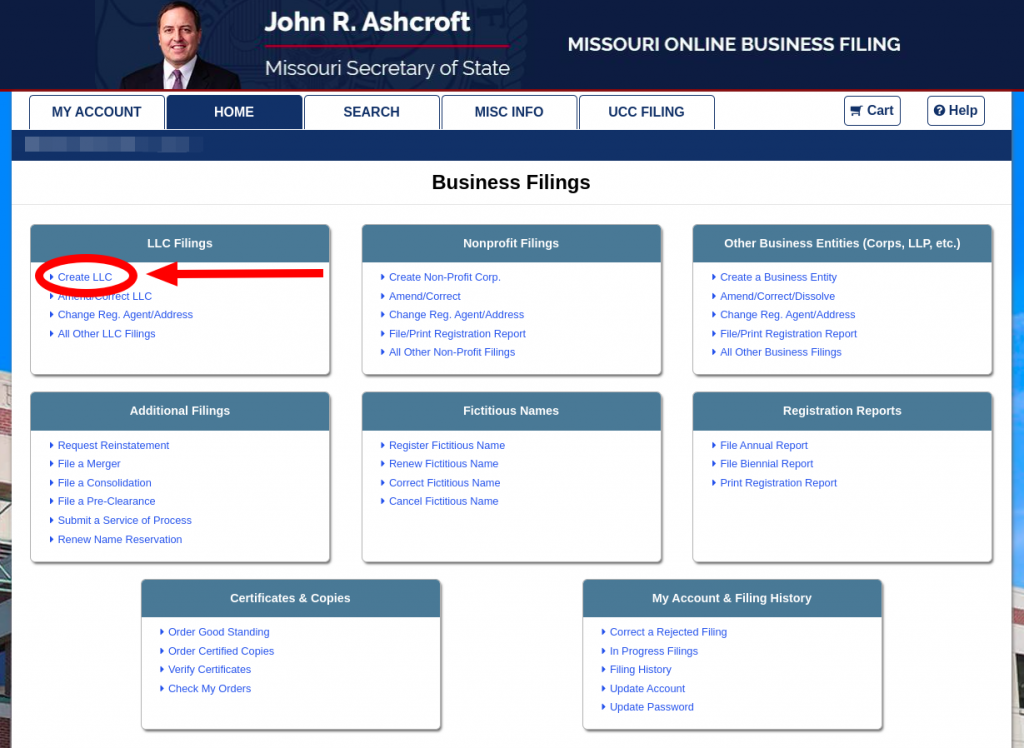

Complete Application for Registration of a Foreign LLC

Now that you’re logged in, you have dozens of different filings to choose from. To register your Missouri foreign LLC, select “Create LLC” under “LLC Filings.”

You’ll be brought to a page that asks you to confirm you want to form a domestic LLC or register a foreign LLC. Make sure you select “foreign” and continue the application.

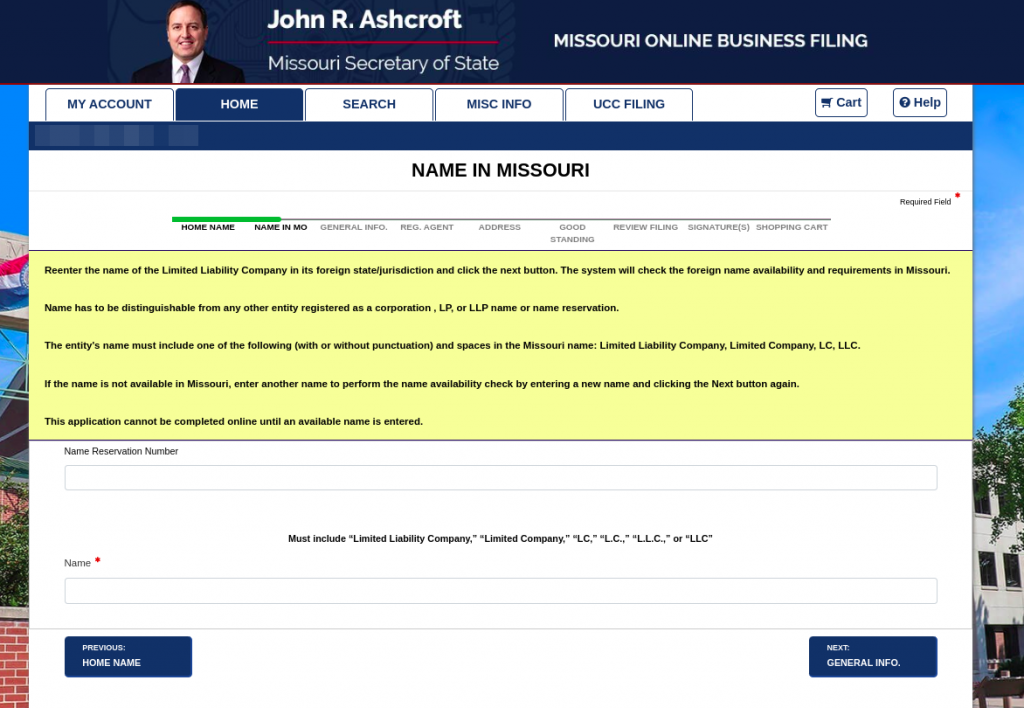

Choose a Name

List the name you’ve chosen for your Missouri Foreign LLC. If you reserved a name, this is where you will use your Name Reservation Number.

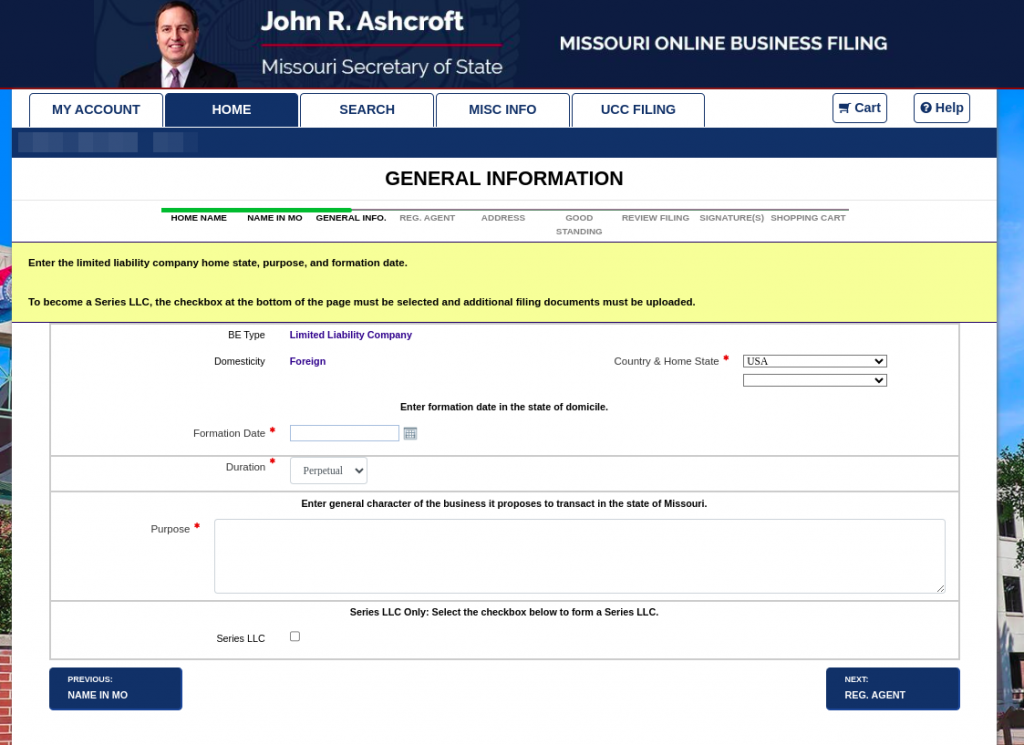

Provide General Company Information

The next page is going to ask you for some general information about your company. You’ll need to include:

-

The date your LLC was formed in your home jurisdiction

-

Whether your company will dissolve on a specific event or date, or if your LLC is perpetual (meaning it will exist until dissolution paperwork is filed)

-

Your LLC’s purpose

-

Whether this LLC is a Series LLC

What is the purpose statement for a Foreign LLC in Missouri?

Your foreign LLC’s purpose statement can be as simple or as detailed as you’d like, just as long as it clearly states the purpose of your company. Basically, be clear about what it is your company does and that you intend on conducting business legally under Missouri Law.

For example, if Tad from Tad’s Toasted Ravs LLC is writing a purpose statement, it might sound something like, “The purpose of Tad’s Toasted Ravs LLC is to prepare and sell multiple kinds of toasted ravioli in the greater St. Louis area. Tad’s Toasted Ravs LLC will conduct and operate lawful business activities allowed in the state of Missouri.”

What is a series LLC in Missouri?

A series LLC in Missouri is an LLC with different, designated divisions called “series.” Each of these series has limited liability protection. It can be a good option if you want to have individual businesses with their own limited liability under a single, sometimes called “parent,” LLC.

If you’re interested in registering a foreign series LLC you’ll want to check the “Series LLC” box on the general information page of the application. You will also need to file Missouri Form LLC 1A with the Secretary of State. You can do this inside your online account.

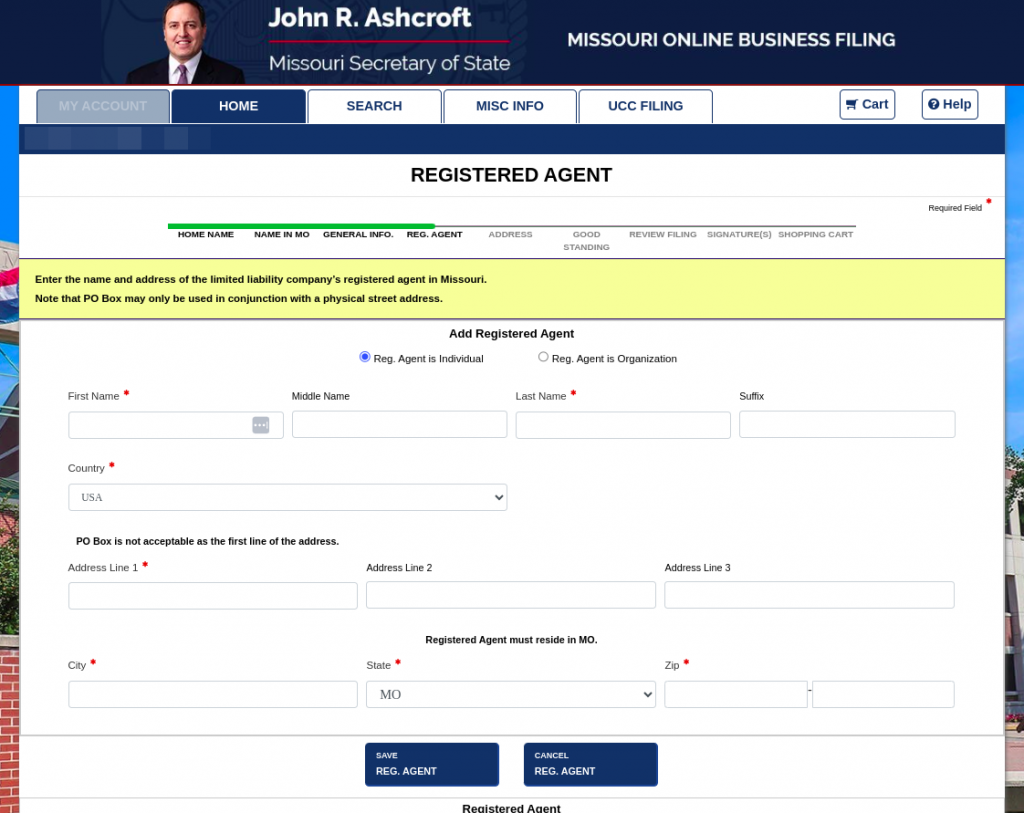

Appoint a Missouri Registered Agent

After you’ve completed the general information page, you will be brought to a page asking for your Missouri registered agent’s information. You can either look up and select the individual or company you plan on using as your registered agent or you can submit their information manually.

Not sure who to trust with your business? Consider Missouri Registered Agent LLC! We’ve helped thousands of small business owners qualify for foreign registration. For just $40 a year, we’ll act as your registered agent. Our registered agent service also includes a secure online account where you can access your important documents 24/7, compliance reminders, and state forms pre-filled with our registered agent information.

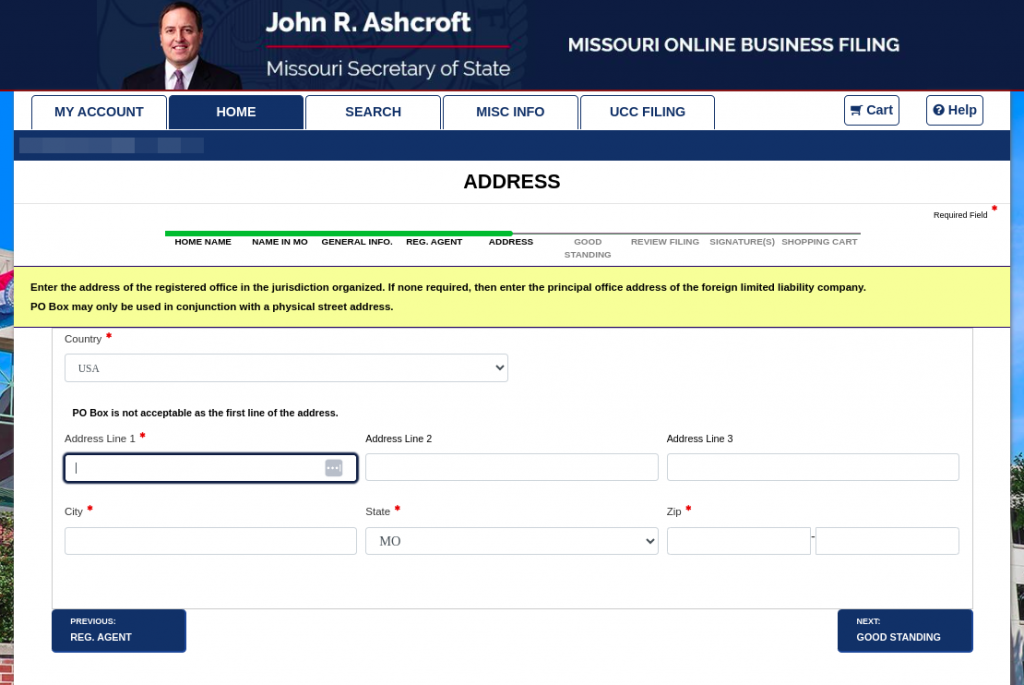

Provide a Business Address

Once your registered agent’s information is submitted, you will need to provide the address of your LLC’s principal office in its home jurisdiction. This address must be a physical address where your business operates.

Can you use a PO box for a foreign LLC in Missouri?

No. The state of Missouri does not allow businesses to list a PO box or virtual office address as its principal office. Sometimes an exception is made for a PO box address if, and only if, that PO box is listed with a physical address, too.

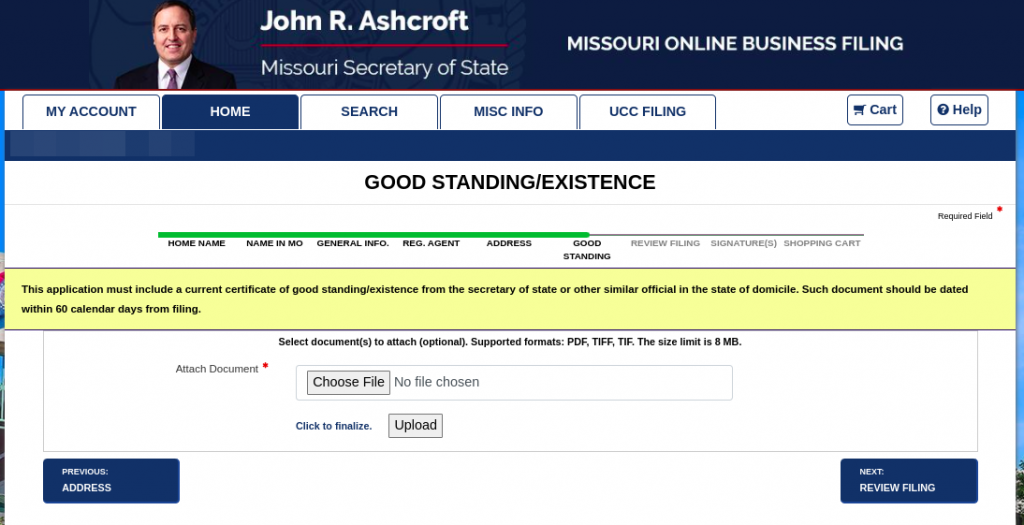

Upload a Certificate of Good Standing

In order for your application to be approved, you need to provide a current Certificate of Good Standing from the Secretary of State (or similar office) from the jurisdiction where you originally formed your LLC. Here is where you will upload your Certificate of Good Standing.

The document you submit must be a PDF, TIFF, or TIF file and no bigger than 8MB. You have the option to upload more than one document if needed.

Review Your Filing

Now you have the opportunity to review your filing. This page will allow you to review your filing before you submit your application. If any of the information is wrong, you can easily return to the other pages and make corrections. This is also where you can save your filing and come back to it later.

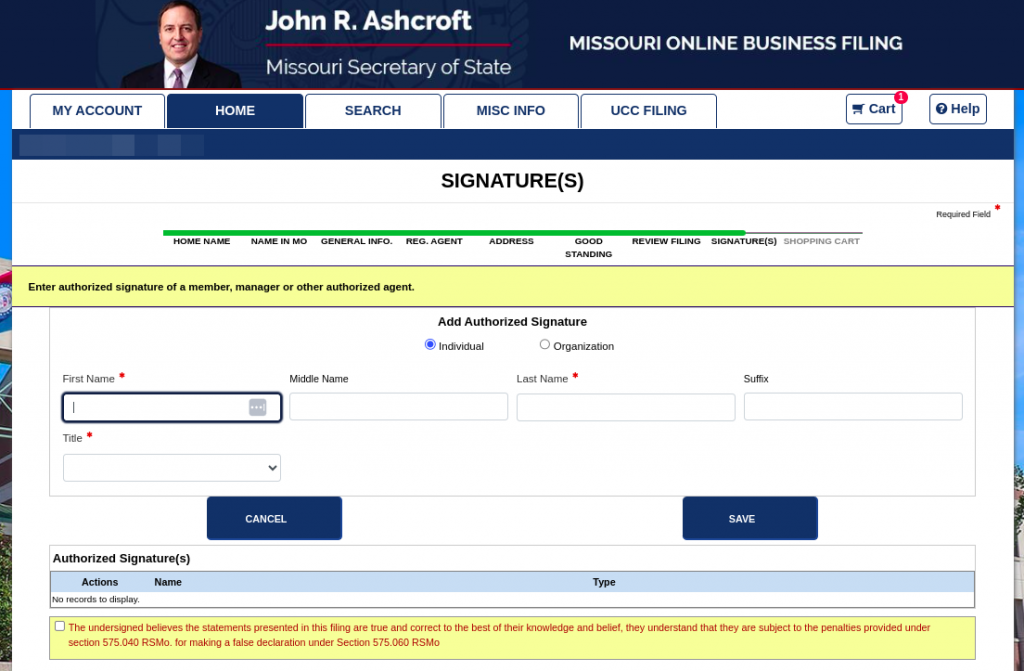

Sign Your Application

If everything looks good on your application, it’s time for signatures. You can enter the authorized signature of either a member, manager, or authorized agent, or any combination of the three. Include their first and last name and title. Be sure to check the yellow box underneath, too. This let’s the state know that you, to the best of your knowledge, have submitted only true information about your company and its signatories.

Submit Your Filing

You’re ready to submit your application! It’s not too late to go back and change information on your application if you need to. You can also add other filings to your cart, as well as order an extra copy of your Certificate of Authority.

You’ll be able to pay for your filing on this page. The filing fee is $105 plus a 2.15% processing fee for credit cards and a $0.50 fee for eChecks.

If you’d like to submit a paper application, you can do so by mailing or delivering your completed application to:

Corporations Division

PO Box 778 / 600 W. Main St., Rm. 322

Jefferson City, MO 65102

Make sure to include a check or money order for the filing fee, made payable to “Secretary of State.” If you’re filing in person, you can pay with a check, money order, cash, or with a credit card. If you do decide to pay with a credit card, you’ll also be charged that 2.15% convenience fee.

How much does foreign qualification cost in Missouri?

Around $105. This price does not include the extra 2.15% processing fee for credit card purchases or the $0.50 fee for eChecks. If you want to avoid this extra processing fee, you’ll need to mail in your application, which will take much longer to process.

5. Get your Missouri Certificate of Authority

Once your application has been approved, your Certificate of Authority will be in your hands in about a week (plus mailing time). This document gives you permission to do business in the state of Missouri!

How long does it take to get a foreign LLC in Missouri?

The time it takes to get a foreign LLC in Missouri depends on how you choose to submit your application. Foreign LLCs that submit their filing online are likely to see their application processed in 1 to 3 days. Paper applications, however, take much longer to process. Usually about 6 weeks.

Missouri Foreign LLC: Things to Know

Now you know what steps to take to register your foreign LLC in Missouri, but there are a few other things you should think about if you plan on doing business in the Show Me state.

Is Missouri a good state for foreign LLCs?

Missouri is an excellent place to do business as a foreign LLC. For a lot of folks, Kansas City and St. Louis are just right across the river. Plus, keeping track of your business’s filings is easy with the Missouri Secretary of State’s website.

Another perk of registering your foreign LLC in Missouri is the cost. Missouri has some of the cheapest fees in the country when it comes to starting and maintaining your business. The state also allows you to list your registered agent’s information on the application instead of your own, keeping your personal information off public record.

What are the benefits of foreign qualification in Missouri?

-

Total privacy. The state allows foreign LLCs to list their registered agent’s information on their application rather than the personal information of the company’s members or managers. After your application is accepted and your Certificate of Authority sent, it becomes public record. Keeping your information off of state documents saves you from having to deal with unending solicitors and junk mail.

-

No annual report. Unlike a lot of other states, Missouri does not require LLCs, foreign or otherwise, to file an annual report with the state. This also means you don’t have to worry about any annual filing fees.

-

No annual state franchise tax. Unlike Missouri foreign corporations, your Missouri foreign LLC won’t need to pay the state any annual franchise taxes. As long as your foreign LLC keeps its default tax status, you won’t need to worry about that pesky franchise tax. (See! We told you it was cheap.)

-

Fast online filing. The Missouri Secretary of State’s website really is easy to navigate. The state has made it simple to keep tabs on your state documents and compliance status. Plus, the faster filing times for submitting online won’t cost you anything extra. Other states may have fast filing times, too, but usually there’s an extra and expensive expedited fee.

Missouri Foreign LLC FAQs

How long is a foreign LLC good for in Missouri?

Your foreign LLC can be active in Missouri for as long as you’d like. If you chose “perpetual” for your business’s duration on your application it will exist unless dissolved.

Is there an annual fee for foreign LLCs in Missouri?

Missouri is one of the few states that doesn’t charge foreign LLCs any annual fees. Foreign LLCs aren’t required to pay any franchise taxes either, meaning once your application has been accepted by the Secretary of State, maintenance costs are low.

Are foreign LLCs subject to taxes in Missouri?

Yes, companies that do business in Missouri are subject to Missouri taxes. Besides any income taxes, businesses may also be subject to Missouri’s Sales/Use taxes and workers’ compensation and unemployment taxes if your company employs workers in the state.